ClickSuper Clearing House

HR3pay has incorporated the ClickSuper superannuation e-commerce solution. This means that you no longer need to log in to multiple superannuation portals to fill out member details and contributions, and you don’t even need to log in to your banking software to make payments. This service can also validate your super fund details.

To commence using ClickSuper services in HR3pay you will first need to complete the relevant application forms and direct debit authorities etc. These steps should be conducted directly via www.ClickSuper.com.au. In the “Service Details” section of the application process, you will be asked for a “File Upload Code”. This code identifies your payroll software provider. The “File Upload Code” for HR3pay is WDPB1L.

Once these steps are completed, there are a number of initial steps required to prepare for your first use of the service in HR3pay.

You will need to activate the ClickSuper Services module within HR3pay. As part of this activation process, you will need to include a new Product License Key (PLK) for your HR3pay database. We suggest you contact HR3 for the PLK prior to starting the activation process.

The activation process involves the following steps:

- Activate ClickSuper Services module in HR3pay

- Enter new PLK

- Provide ClickSuper LoginID and Password

- ClickSuper Product Search – Fund Validation

- Exclude Super Funds (if necessary)

- From the Navigator, select Security | User Maintenance.

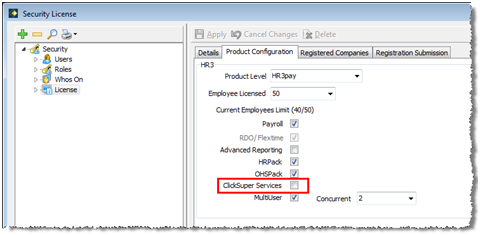

- Click on the License tree node and select the Product Configuration tab. The following screen will be displayed:

- Tick the ClickSuper Services option and click Apply.

- A pop-up screen is displayed, prompting you to input your new PLK. (If you haven’t previously contacted HR3 for this PLK, you will need to call the HR3 support team now to get a new PLK issued.)

- Type in your new PLK and click OK.

As part of the registration process for ClickSuper, you will receive a Login ID and Password from the ClickSuper team. Once you have received your ClickSuper Login ID and Password, you will need to enter these in HR3pay, as per the next steps:

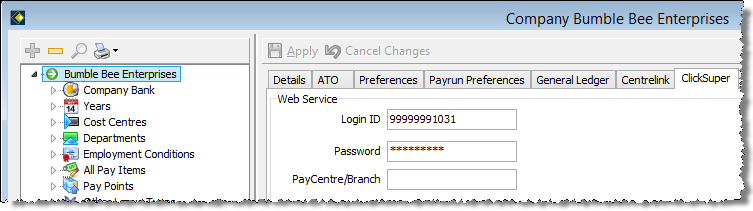

- From the Navigator go to Company | Maintain Company and then select the ClickSuper tab on the right hand side of the screen. The following screen will open:

- Type in your Login ID and Password and click Apply. The Security License window can now be closed.

You have now activated the ClickSuper Services module of HR3pay.

This is an option that may be available within Super Funds, if you have registered for the ClickSuper service - it gives you the ability to validate your

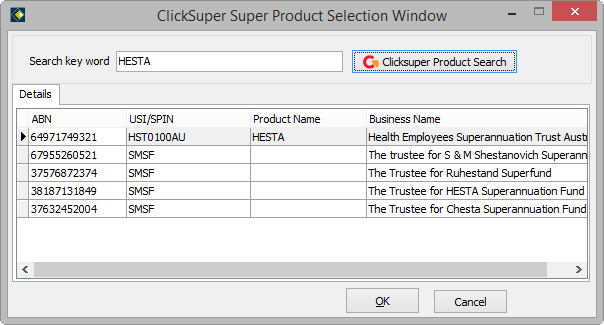

- Click on the ClickSuper Product Search button and a screen similar to “Figure 1 - Example ClickSuper Product search” will open:

Figure 1 - Example ClickSuper Product search

NOTE: The initial search results are based on trying to match your existing fund Name. In many cases your existing fund Name may not be correct and therefore you may not get a correct match. Examples of incorrect matches will include funds with a space where there should be none (e.g. Sun Super instead of SunSuper), incorrect abbreviations (e.g. H.E.S.T.A instead of HESTA) and so on. If there is no matching entry in the pop-up list, try typing in the fund’s ABN or USI/SPIN as you are much more likely to get an exact match on these.

- When you have a match, click on the correct entry in the list and click OK. The relevant sections for that fund Name in HR3pay will be completed.

- Click Apply to save the changes and leave the window open, or OK to save the changes and close the window.

- Repeat for all other funds that you wish to include in the ClickSuper upload.

You may wish to exclude certain funds from the ClickSuper service. An example might be a Defined Benefits Fund, as the ClickSuper service does not cater for Defined Benefit Funds. To exclude a super fund from the ClickSuper process, tick the ‘Exclude from ClickSuper’ option for the relevant funds.

Special note on BSBs and Account numbers. You must specify the BankStateBranch and Account No. for any Self Managed Super Funds (SMSF’s) in order for ClickSuper to be able to make the EFT payment to the fund. It is not necessary to specify BSBs and account numbers for Retail funds or Industry funds (e.g. any fund with a SPIN) as ClickSuper already holds all of these.